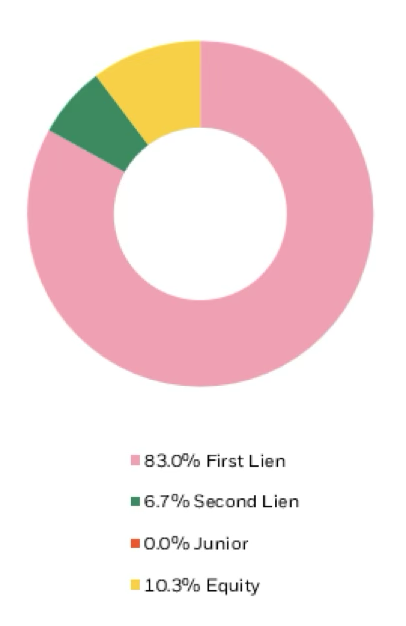

As of September 30, 2025, BlackRock TCP Capital Corp.’s investment portfolio consisted of debt and equity positions in 149 portfolio companies with a total fair value of approximately $1.7 billion. Debt positions represented approximately 90% of the portfolio fair value, substantially all of which were senior secured debt. Equity positions represented approximately 10% of the investment portfolio.

As of September 30, 2025, the weighted average annual effective yield of our debt portfolio was approximately 11.5%. (1) As of September 30, 2025, approximately 94.2% of our debt portfolio at fair value had floating interest rates.

(1)Weighted average annual effective yield includes amortization of deferred debt origination fees and accretion of original issue discount, but excludes market discount, any prepayment and make-whole fee income, and non-accrual and non-income producing loans. Weighted average effective yield on the total portfolio (including non-accrual and non-income producing loans and equity investments) was 10.3% as of 9/30/2025

(2)Industry classification system generally categorizes portfolio companies based on the primary end market served, rather than the product or service directed to those end markets. Data as of September 30, 2025. “Other” category includes industries less than 3% of total investments. Past performance does not guarantee future returns.